Facility Financing 101

Facility Financing

Charter school operators require access to different forms of project funding over the course of facilities development. Beyond typical fundraising, which generally acts as a leave-behind equity contribution from the school, there is the need for financing to fund predevelopment, acquisition, and construction. As charter school operators grow and stabilize their operations, they are often in need of short-term, mini-perm loans to fund the construction and first few years of operation in the developed facility, followed by refinancing with longer-term/permanent financing once the school reaches stabilization.

All of these forms of debt are required in a healthy lending and building environment and are critical to the successful growth and expansion of any charter sector.

Types of Lenders and Loan Products

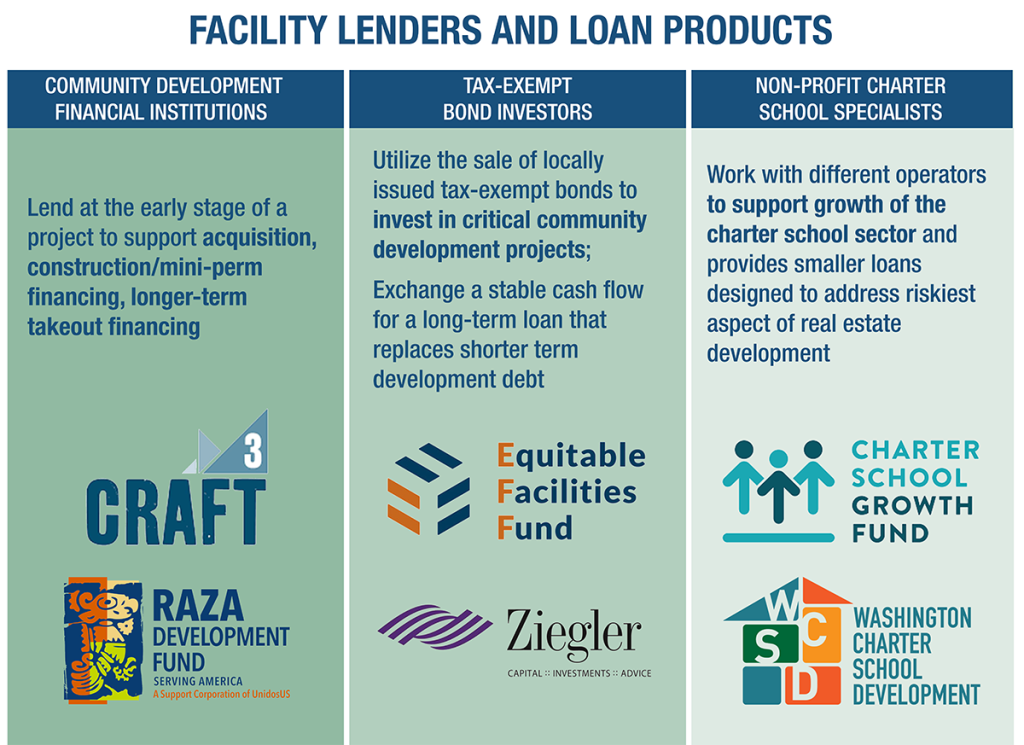

Various lenders specialize in providing different forms of debt. One key group of lenders is the Community Development Financial Institutions who, through their years of work with the charter sector in various states, have developed a clear understanding of the needs of their charter partners, the risks associated with investing in a niche product such as charter schools, and the economic, social, and community benefits that their investments drive. This group generally lends at the early stage of a project to support the acquisition, construction/mini-perm financing, and, on occasion, longer-term takeout financing.

Another key group of lenders and investors is the tax-exempt bond investors. These groups of private equity and institutional investors take advantage of the sale of locally issued tax-exempt bonds to invest in critical community development projects. As such, they exchange a stable cash flow for a long-term loan that normally supplants and replaces all previous shorter-term development debt.

Finally, there are the non-profit charter school specialists that work with and through different operators to support the growth of the charter school sector. These entities typically provide smaller loans that are designed to address the riskiest aspects of real estate development, the initial work to evaluate the viability of a new school building.

Tell us about the current facility lending and financing landscape in Washington.

Availability of Loans to Charter Schools in WA 2014 vs 2022

In 2014, Washington Charter School Development entered into the Washington Charter market with a specific mandate to build three new schools. This was made possible by grants to WCSD and loans from a single Community Development Financial Institution. Since the delivery of the initial facilities in 2015, and with more than 6 years of operating data and the first renewals of charters in WA, there has been increased lender interest and participation:

Lenders in the WA charter market through May 2022

Through May of this year, increased lender interest has generated more competitive terms and the provision of critical long-term financing options, which, in turn, stimulate more interest from short-term lenders. Over the last 5 years, we have seen historically low interest rates. We have also seen the participation of the tax-exempt bond investors in the WA marketplace, which has meant WA charter schools have been locking in low and affordable finance rates for the facilities they are occupying, thereby creating sustainable and predictable operating expenses. We have seen one additional innovation in facility funding in WA: the emergency of publicly funded WA charter school facilities. Two programs, one in Wenatchee and one in Spokane, have been successful in raising public funds through local legislative support to develop new facilities for public charter programs. We anticipate that these projects will act as a guide for future funding for education facility projects in WA.

Interest rate hikes since May 2022

Over the last 6 months, there have been some dramatic moves by the Federal Reserve to raise the cost of debt in an attempt to curb the current high rate of inflation in the US. This has and will continue to have an impact on raising the cost of capital and will make borrowing more expensive for schools. In turn, this will force school projects that are looking to break ground in the coming 18 months to fundraise more equity and focus on only critical aspects of their programs as they develop their facilities plans.

What are lenders looking for before investing in a school?

Lenders generally look for stable operations and financials that reflect positive Net Operating Income (NOI) or at least trend toward positive NOI. They generally look to lend to high-performing schools with experienced staff and with a deep board. Finally, in WA, they want to see how well the school is doing in achieving its mission and serving the students and communities it highlighted in its charter application. Like any lender, they want to make sure their investment is secure and that it will be paid back in the period that is agreed to.

What is the best way to establish and maintain relationships with lenders? What are your tips for engaging with them?

There are several lending entities that are active and present in WA. It is strongly advised that the school meet with these folks and discuss its current work and plans for the future on a regular basis. Introductions can be obtained by WA Charters or WCSD. By maintaining these relationships before a loan request is made, it provides the school with the best chance of successfully navigating the underwriting that follows and obtaining the most competitive rates available. I would say in terms of tips for engagement, it’s about striking a balance between being open and transparent and positive regarding outlook and projections.

What do you wish schools knew about the facility lending?

Schools should take time to develop a solid set of 5-year projections based on reality and support your growth objectives. This should be done before a loan is requested and should align with historical enrollment data and projected fundraising.

What are your top 2-3 pieces of advice for first and second-year schools around facility improvements during early years of growth?

- Engage with WCSD as early as possible.

- Consider how your short-term incubation goals fit in with your longer-term expansion goals.

- If possible, identify a facility that will allow you to improve and house your growing school through a series of phase improvements. An alternative, if available, is incubating the school for 2-3 years in turnkey education facilities, but they are generally few and far between.

How about for schools looking to expand and add to their initially chartered grade levels?

Again, planning for growth should be done in conjunction with plans for long-term stability and sustainability. If you are considering replicating the model at some point in the future of the school, then also consider how types and amounts of debt may constrain your ability to borrow and grow in the future.

Just like philanthropy, the lending landscape can perpetuate funding inequity. In our sector, it is especially true for newer and Global Majority school leaders and independent schools that don’t have an operating track record. Can you reflect on ways we’ve addressed this as a sector, and in what ways is your organization advocating to create a more equitable lending landscape?

WCSD created the WA Facility Fund to address inequities in the facility funding for early-stage schools and schools led by and focused on communities from the Global Majority. The fund is designed to support schools in two critical ways, early design assistance grants, and low-cost subordinated loans. The fund is designed to augment the traditional forms of financing and backstop the perceived risks traditional lenders have of emerging programs with limited operating history and limited capital reserves.